New competitors and Gen-Z consumers are forcing much-needed evolution in the space.

–

As much as shopping formats and preferences have changed over the last couple of decades, one thing has remained the same: Everyone loves a deal.

It's no surprise, then, that consumers are now spoiled for choice when it comes to affordable shopping categories, from fast-fashion giants and secondhand marketplaces to rental services and, of course, the OG purveyors of discounted clothing: off-price stores — your Nordstrom Racks, T.J. Maxxes, Saks Off Fifths. But with so much newness in the space, some of those old standbys started to show their age.

Despite the occasional cheesy ad campaign (who do I sue for hitting us over the head with the phrase "Maxxinista" in the 2000s?) and relatively recent forays into e-commerce, off-price has remained a pretty boomer-y and unsexy segment of retail. A famously recession-proof business model, off-price retail entities never had to do as much as their full-price counterparts to attract bargain-hungry shoppers — until now.

This spring, Saks Off Fifth relaunched with a new visual identity, campaign, tagline ("where fashion takes off") and loyalty program, all of which reflect the retailer's new digital-first model. This evolution began taking shape in 2021 after Off Fifth's e-commerce business was spun off into its own entity with a $200 million equity investment led by Insight Partners. (Hudson's Bay Company continues to operate the physical locations.)

So far, this investment in digital seems to be paying off: A new app already has more than 1 million downloads, and digital revenue grew 50% in 2021.

"I think the pandemic gave us a chance to really reimagine what traditional off-price looks like," Sara Griffin, senior vice president of marketing at Saks Off Fifth, tells me on a recent call. "Saks Off Fifth has a really significant opportunity to win in what is an underserved luxury off-price sector. We really are uniquely positioned to benefit from the convergence of two distinct but related forces: this growth that we're seeing in the off-price sector along with the continued expansion of digital, particularly when it comes to online luxury retail."

Off-Price Goes Online

Historically, off-price retailers have avoided e-commerce. To be fair, it's uniquely complicated for them: While full-price operations can plan their assortments months in advance and sell large quantities of individual items that only need to be shot and listed once, off-price retailers' inventory is constantly changing. There's also the argument that the "thrill of the hunt" of in-person deal shopping can't be replicated online — which, sure, there was something exciting about unearthing a Chloé blouse for 90% off at Century 21 after hours spent scouring the racks, but who has the time anymore?

Another issue was (and still is) the reluctance from luxury companies to participate for fear of brand dilution. Some would literally rather burn $37 million worth of unsold luxury merchandise than risk it being seen an environment over which they don't have full control. Others were only willing to offload excess inventory to physical off-price stores because they could more or less keep the arrangement a secret from their full-price customers; a quick Google search, however, could reveal all if those items got listed online.

"Brands are conflicted with how to protect their image and ensure that they aren't seen as a discount brand," says luxury retail consultant Robert Burke.

Things started to change when The Outnet launched in 2012, bringing discounted past-season luxury fashion online for basically the first time. Fellow off-pricers started to follow suit. But beyond debuting basic websites throughout the mid-2010s (some of which have since shuttered), they continued to do the bare minimum when it came to things like tech, branding, and customer service — and many of them got away with it because the discounts alone generated enough business.

Getting Gen-Z On Board

To put it in the preferred dialect of Gen Z, off-price retailers simply had "zero vibes." They were, as the kids say, "giving nothing." And it's largely because of that generation and their growing spending power — Bank of America predicts their income will surpass that of millennials by 2031 — that retailers like Saks Off Fifth are finally starting to give us something.

Gen Zers seem to love a deal as much as the next generation, but they've grown up digitally fluent and spoiled for choice when it comes to fun, disruptive, engaging new places to shop, and probably think off-price stores are cheugy.

"Young consumers in particular are looking for almost the same level of styling and marketing as they'd expect from a full-price item," says Burke. "Simply being discounted isn't good enough anymore."

Gen Zers expect a seamless omnichannel experience, strong customer service, cool branding, brands that align with their values and a specialized, curated assortment, regardless of price point. Many off-price retailers fell behind when it came to offering those things.

"Extensive" customer research went into the Saks Off Fifth rebrand, according to Griffin, including a survey of 5,000 consumers that had participants from the younger generations it hopes to reach. "Seventy-five percent of them describe shopping as a hobby," she tells me of the results. "They stay on top of all the trends, but they're also really not afraid to mix and match across high/low brands."

On top of investing in digital, Saks Off Fifth has been overhauling its brand assortment with younger shoppers in mind, adding over 500 new brands in the last two years, with plans to add another 300 by the end of this year.

"It's about premium designer brands, but it's also just about really cool, coveted brands that are new and emerging," says Griffin. Contemporary labels like Good American, Reformation and By Far will soon arrive on the site for the first time.

On the marketing front, the retailer has also been hosting experiential pop-ups, testing new social media channels and making an effort to communicate its "values" — a word that, until recently, had probably never been uttered by an off-price retailer in reference to anything other than price.

"[We're] making sure that everything we do really speaks to the ideas of representation and self-expression, which we're seeing resonate with this core customer," says Griffin. In June, for example, the retailer partnered with the Phluid Project and the Phluid Phoundation on a Pride campaign.

According to Burke, The Outnet — with its luxury curation and editorial content — "has been the benchmark the last few years for online off-price." But when it comes to older retailers pivoting to stay relevant, Saks is coming out on top, having done "a particularly strong job at catering to the younger generation the past year."

"Last year, we retained customers at rates faster than ever before, while acquiring new customers in line with or better than any of our digital-only peers," says Griffin. "We've seen really rapid growth in the last two years in our under-40, even under-30 segment. They're definitely gravitating towards the brand like never before."

Competition Heats Up

All that said, neither of them should get too comfortable, as a number of cool, young, digitally-savvy competitors are coming for their business.

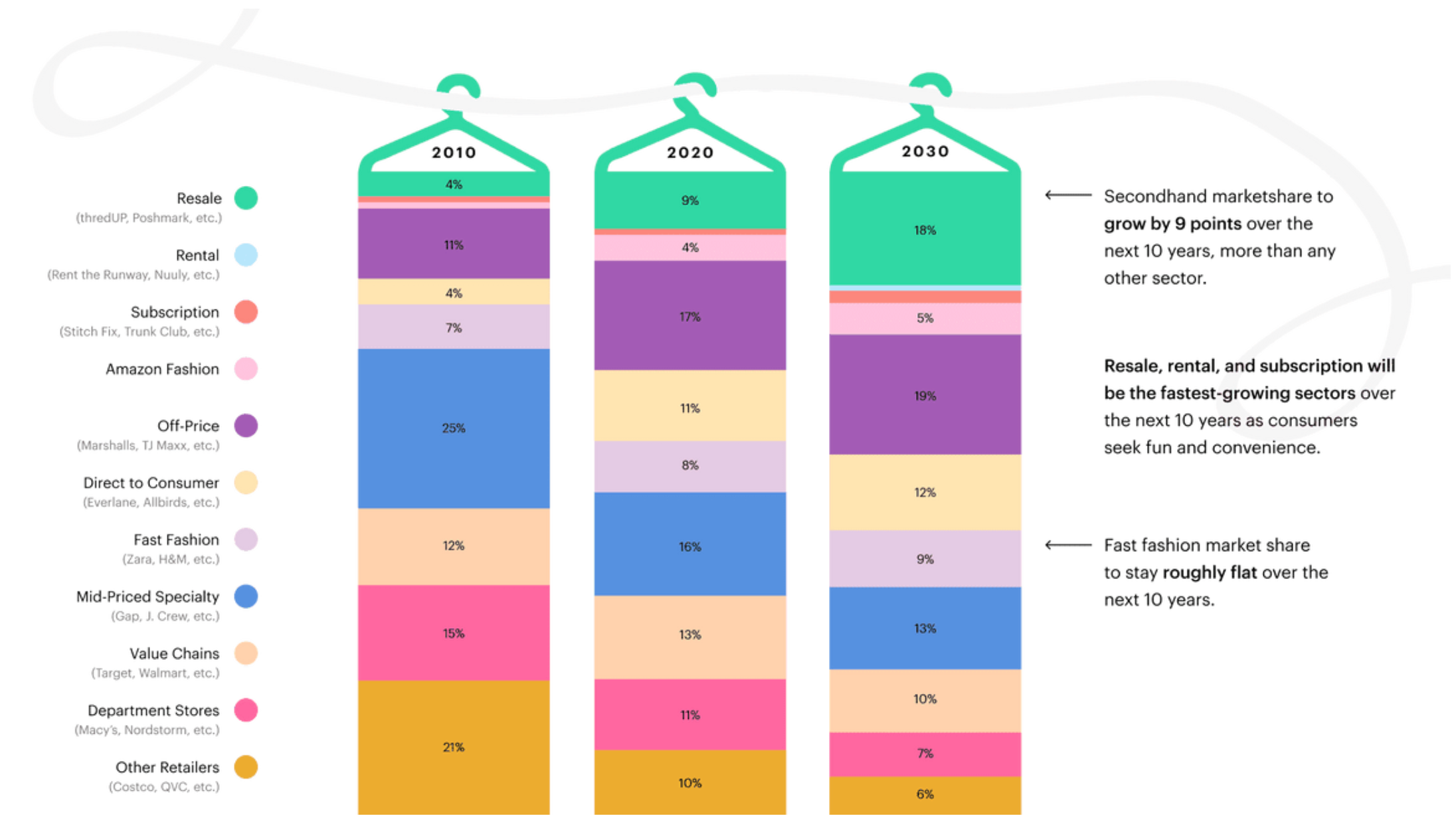

Resale — another value-driven fashion category — is probably now off-price's most threatening competitor, given the success of Thredup, The RealReal, Rebag, Depop, Poshmark and the like. (Interestingly, there are many parallels between the recent evolution and destigmatization of secondhand retail and the changes we're now seeing in off-price retail.) Per Thredup and GlobalData's 2022 Resale Report, the category is expected to grow 16 times faster than the broader retail clothing sector by 2026.

A page in 2021's report illustrates how resale is encroaching on off-price's "closet share": In 2010, resold clothing made up 4% of the average person's closet, while off-price purchases made up 11%; by 2030, it'll jump to 18%, barely trailing behind off-price's 19%.

There are also some promising new entrants into the off-price space hoping to give the OGs a run for their money.

Offe, launched in 2018, feels like an off-price Lisa Says Gah (and in fact sells excess inventory from LSG and other likeminded indie brands, such as Rachel Antonoff, Boy Smells and House of Sunny). With its curated assortment, modern aesthetic, original lifestyle photography and plentiful vibes, offe.market doesn't feel like an off-price site. And that's by design.

Founder Rachel Gannon came up with the idea while working at the brand Ban.do, which, to her dismay, sold its excess inventory to T.J. Maxx. "You just picture it sitting in there, and you have no control over the visual of it," she says. "In my opinion, it diminishes the brand integrity. And we'd been working so hard to elevate the brand."

Having previously worked at RueLaLa and Macy's, Gannon understood the off-price market — its strength as a business model, and the fact that most existing players had failed to evolve with the times. "They've completely left millennials and Gen Z behind. They're not adapting to how they want to shop. They're not being innovative at all, and I think that just goes back to how their infrastructure is set up so traditionally," she says. "It would be a huge undertaking for them to try to go after an omnichannel or e-commerce way of selling now."

With its aesthetically pleasing e-commerce experience and flexible terms, Offe aims to provide a relatively simple and shame-free path into the off-price channel for brands that previously avoided it. The brands, in turn, bring in new customers. "Since we're an important, recurring partnership for a lot of the brands we work with, they'll post about us to their Instagram following, which is really nice," she says.

Eventually, Gannon wants to carry bigger brands and expand into more categories, eventually becoming "the go-to for every brand to liquidate inventory."

Though, she may want to heed the advice of Burke, who's bullish on curation: "Bigger is not always better for younger consumers today, especially online, because they don’t want to wade through thousands of products. They want to go somewhere that represents their taste level and what really interests them."

If Offe caters to the indie girlies (for now), Heat — launched in 2019 by two Gen-Z founders — caters to the hypebeasts with an entirely new way of monetizing brands' unsold inventory. It sells mystery boxes containing discounted items (for $675, you get $1,200 worth of product) from luxury streetwear brands like Off-White, Casablanca and Fear of God, released via limited monthly drops on Instagram and YouTube.

In January, the company raised $5 million in seed funding from a group of strategic investors including LVMH and Antler as it endeavors to become, as Vogue Business put it, "a Gen Z e-commerce leader across mystery boxes and retail."

Then there's Otrium, which puts Heat's $5 million to shame, having raised $146 million to date. The European startup operates a retail-as-service platform, allowing brands like Adidas, Reiss and Karl Lagerfeld to list and sell their past-season merchandise on its mobile app, all while retaining control over their own pricing and merchandising.

The Future of Off-Price

Resale may be a massive phenomenon, but it won't be eclipsing off-price anytime soon. It's like the cockroach of retail categories — and there wouldn't be all these new players if there weren't still plenty of opportunity, especially given its proven ability to thrive in economic uncertainty.

"It can survive anything, which is how these major retailers have been around for so long, how they bounced right back after COVID," Gannon says.

The less digitally-adept off-price retailers did suffer from lost brick-and-mortar revenue during the pandemic, but most recovered quickly upon reopening. Many have even confirmed expansion plans in recent months: Macy's recently opened 37 new Backstage shop-in-shops; Ross and Burlington said they plan to open 100 and 120 new stores this year, respectively; The Outnet just expanded into menswear. Meanwhile, experts largely agree that off-price will benefit from inflation — expected to rise by 8.8% in June compared to last year — as shoppers look for deals. Of course, so will resale.

Off-price has appeal beyond value, too. Because items are new and sourced directly from brands, consumers needn't worry about their condition or authenticity the way they might in the secondhand market. Meanwhile, both models can be pitched as sustainable.

"Almost every time a customer is giving us positive feedback, they're like, 'I love that I'm mindfully shopping. I'm a big thrifter,'" says Gannon. "I think we really appeal to those millennials and Gen Z because that's really important to those demographics."

"Off-price is on track to accelerate its growth in part due to the consumers' focus on sustainability," echoes Burke. "There will continue to be an overstock of clothes produced, even in the luxury sector, so off-price allows those items not to go to waste."

Ongoing supply-chain issues could provide even more inventory for off-price retailers. Plus, Burke predicts that we'll see more reluctant brands exploring off-price for the first time.

"Brands are still figuring out how to position themselves in the off-price market," he says. "They don't want to hurt their full-price business but need to take advantage of unloading overstock products and strengthening their customer base. The off-price customer is spending more than ever, so brands need to capitalize."

New companies like Offe, Heat and Otrium stand to bring in business from these once-hesitant brands — that is, if the brands themselves don't find new ways to sell their excess inventory directly to consumers — in much the same way that many have taken control of their own resale as the secondhand market became too large of an opportunity to ignore.

Burke believes the retailers with the best brands will have a leg up: "Off-price retailers are equally judged by the brands they carry and by the brands they don't carry."

As viable as off-price retail may continue to be, there isn't necessarily room for everyone to succeed. As competition heats up, Burke argues we'll see even more investment, change and innovation in this once-stagnant category, especially as retailers focus more on courting Gen Z. In other words: The vibes are coming, and off-price is going to start looking less and less like off-price.

"We're going to see off-price closely mirror full-price from an edit, communications and customer service standpoint," he says. "The consumer won't accept anything less."